Switzerland

Company formation -

Best Prices on the market

We specialize in the registration and maintenance of Swiss companies

Your Companyfrom €890

Our swiss team specializes in the registration and incorporation of low-tax Swiss companies. We offer the Best prices on the Switzerland market. Our country is known for its steady economy regime, stable political status and its good banks. For these reasons many international clients or corporations choose to open a Swiss company or branch.

We work worldwide for private and corporate clients, other company formation agents, tax consultants, accountants and attorneys in the establishment and creation of legal and tax compliant structures to extensive corporate advisory mandates.

A complete range of optional services can be ordered for your new company in Switzerland - like company management services, bank introductions, mail forwarding, communication and relocation services.

Our team consists of experienced financial experts, economists, lawyers and trustees, which aim to maintain long-term and prosperous relationships with our clients.

You have specific requests? We help you realize them!

1. Legal Forms

Switzerland has two different forms of companies:

a. Stock Company (AG)

b. Limited Liability Company (GmbH)

The AG has a minimum share capital of CHF 100'000.- and a GmbH of CHF 20'000.-. As the

owners of a

GmbH are public and visible in the commercial register, they are not visible with an AG.

Thus, an AG

provides more anonymity. In addition to that, the transfer ability of shares is much easier

with an AG. For

international structures, we therefore usually recommend an AG.

2. Documents for commercial register (KYC)

As the owners of an AG in Switzerland remain anonymous, no ID or any other KYC documents

need to be submitted. The situation is different with a GmbH as the commercial register

requires a copy of the

passports from the owners. Board Members and Directors with signatory-rights need for

registration into the commercial Register either a Swiss certification (Notary Public) or an

overseas Apostil.

3. Board of Directors

Each Swiss company requires at least one Board Member, who resides in Switzerland. This

Board

Member is personally responsible for a compliant and proper management of the company.

Therefore,

the Board must conduct certain control functions, which are set forth on a case by case

basis in a mandate

contract.

4. Procedure of a Formation

Initially, the formation procedures (legal form, bank, company-purpose, domicile, directors,

etc.) have to

be defined in detail. After this has been defined, the seed-capital has to be paid into a

Swiss bank account.

After this payment the formation will be conducted by a Swiss notary and he will also make

the entry in

the commercial register.

5. Timeframe

If everything goes perfectly smooth, we can form a company within two weeks. But our

experience shows

that it usually takes much longer because many questions have to be cleared before

formation.

6. Costs

Our costs can be taken from a separate pricelist. Normally we will require a deposit before

we begin work. In addition therwill be third-party costs such as for the Notary, the

commercial register and the

bank. Depending on the specific case these costs are variable.

7. Is a Visit to Switzerland necessary?

No, for a company formation, you do not need to come to Switzerland. However, in order to

establish

a mutual and trustworthy business relationship, we recommend our customers to do so.

In the following cases, however, a personal visit is mandatory:

a. a bank requires this for account opening

b. If the customer wants to have signatory-rights (unless he makes an Apostil abroad)

8. Bank account

Of course, we also offer bank account opening. Please note, that the banks require detailed

information so

they can accurately analyze the sources and use of funds. In addition to that, the bank

might want to know

the beneficial owners (shareholders). For this procedure we have a separate form that must

be completed

by the customer.

9. Control rights of the Owner

The owner of a company exercises its control by share certificates. In Switzerland there are

two types

of shares:

a. Bearer shares

b. Registered shares

The owners of registered shares will be listed on the stock certificates by name. There is

also a sha register, which is signed by the President of the Board. For bearer shares, no

name is registered and there

is no register of shareholders.

10. Shelf Companies

We also provide existing ‘empty’ companies (so called shelf companies). We have a separate

pricelist

which includes all the costs, with the exception of fees for the Notary, the commercial

register and the

bank fees.

11. Corporate Taxes

Every company in Switzerland has to pay tax on the profit. The calculation of the total tax

burden is very

complex and depends on the domicile of the business (tax rates differ from canton to canton

and also

between communities) and also on the business model (e.g. tax relieves for offshore -

business, dormant

companies such as Holdings etc.) Therefore, there is a wide range of 9% to a maximum of 35%

tax

burden on net profit. Due to the complexity of the Swiss tax system it is absolute necessary

to make a

professional analysis.

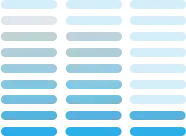

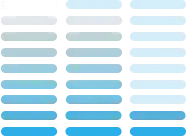

The numbers of company formations per year

2

Zug

3

Baar

1

Schwyz

4

Zug

2

Baar

2

Schwyz

5

Zug

4

Baar

2

Schwyz

8

Zug

7

Baar

2

Schwyz

9

Zug

8

Baar

2

Schwyz

2020

2021

2022

2023

2024